In today’s interconnected world, the importance of robust identity verification cannot be overstated. Digital ID — a transformative innovation reshaping how individuals verify their identities across sectors, particularly within Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance frameworks. It serves as a secure electronic representation of an individual’s identity, encompassing key personal attributes such as name, date of birth, address, and increasingly, biometric data. This evolution marks a significant departure from traditional paper-based methods, offering enhanced security and efficiency in identity verification.

The process of verifying digital identities integrates advanced technologies and methodologies

- Collection of Digital Credentials: Customers provide digital copies of identity documents, digitally stored and authenticated.

- Biometric Authentication: Utilizes fingerprints, facial recognition scans, and iris patterns to verify identities securely.

- Artificial Intelligence (AI): AI algorithms analyze data for authenticity, detecting anomalies that may indicate fraud.- Database Validation: Information cross-checked against government and financial databases ensures accuracy and legitimacy.

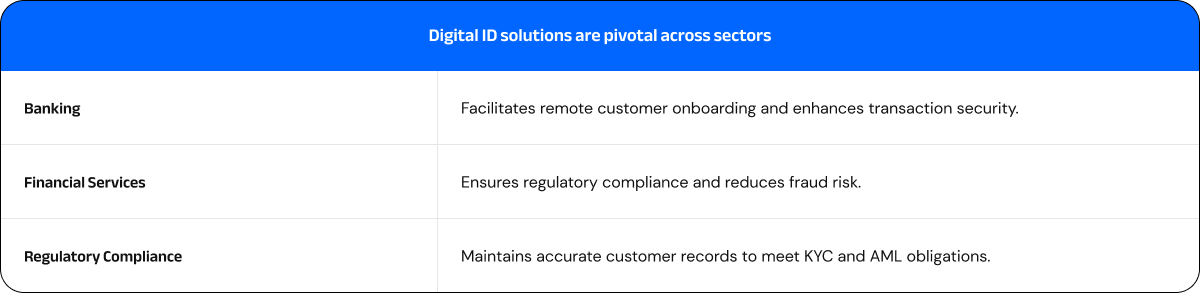

Digital ID fuels economic empowerment by unlocking new opportunities for businesses and individuals alike. By streamlining identity verification processes, Digital ID reduces barriers to financial inclusion and facilitates broader access to financial services. This not only enhances consumer convenience but also stimulates economic growth by enabling more efficient transactions and reducing operational costs for businesses.

In the banking sector, for instance, Digital ID enables remote customer onboarding and account management, eliminating the need for physical presence and paperwork. This enhances customer satisfaction and reduces financial institutions' administrative burdens and operational expenses. By leveraging Digital ID, banks can offer more personalized services tailored to individual customer needs, thereby fostering stronger customer relationships and loyalty.

Adopting Digital ID offers several key advantages:

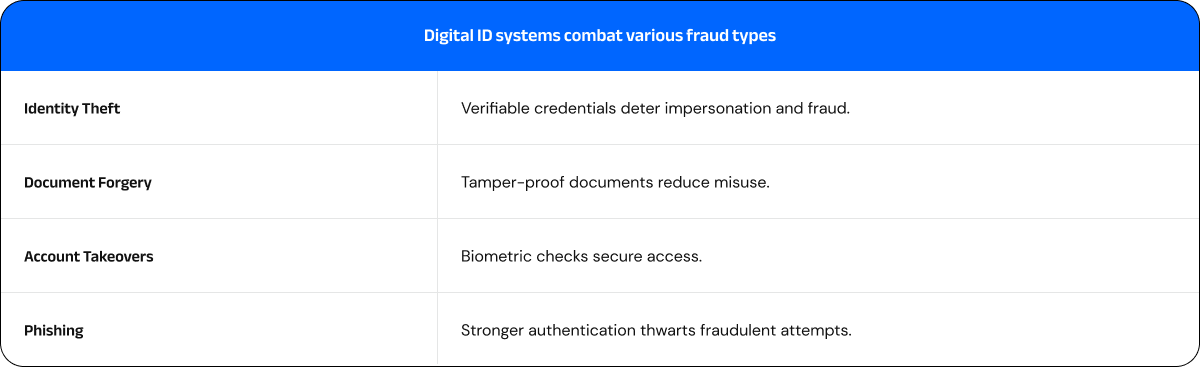

- Enhanced Fraud Prevention: Secure credentials and biometric authentication reduce identity theft and account takeovers.

- Improved Efficiency: Streamlines verification, lowers costs and speeds up onboarding processes.

- Better Customer Experience: Provides a seamless, user-friendly verification journey.

Regulatory compliance remains a cornerstone of Digital ID implementation, particularly within sectors governed by stringent KYC and AML requirements. By integrating strong identity verification solutions, businesses can mitigate compliance risks and enhance regulatory adherence. Digital ID enables real-time monitoring of transactions and activities, facilitating prompt detection of suspicious activities and potential fraud.

As businesses adopt Digital ID systems, ethical considerations surrounding data privacy and consumer protection take center stage. Safeguarding personal information and ensuring transparent data practices are crucial for fostering trust and complying with regulatory standards. Businesses must implement robust data protection measures and adhere to global privacy regulations to secure customer identities and prevent unauthorized access. Transparency in data usage and consent mechanisms is equally vital, empowering individuals to make informed decisions about their personal data usage. By prioritizing ethical deployment practices, businesses can uphold consumer trust and cultivate positive relationships with their clientele.

Governments and financial institutions globally are increasingly adopting these systems, fortified by cutting-edge technology and rigorous governance frameworks. Government endorsement of digital ID systems, as highlighted by the FATF (2020) isn’t just a nod to innovation; it’s a testament to a system’s reliability and adherence to regulatory scrutiny. This endorsement streamlines processes for businesses, enabling them to focus on growth while meeting compliance obligations effectively. It serves as a green light, indicating that a system has undergone a thorough evaluation and meets the highest standards of security and trustworthiness.

In the realm of financial integrity, a one-size-fits-all approach is not sufficient. Evaluating digital ID systems involves nuanced, risk-based assessments that account for diverse challenges posed by customers, products, and geographical regions. This dynamic approach not only fortifies defenses against financial misconduct but also fosters innovation in how individuals are identified and engaged with on a global scale.

Future Trends and Innovations in Digital ID

As technology continues to evolve, so too must our approach to identity verification. The frameworks underpinning digital IDs are designed to be agile, accommodating advancements while upholding stringent standards of security and privacy. This adaptability not only future-proofs our financial systems but also enhances access to financial services, promoting greater financial inclusion and economic empowerment worldwide.

Transparency builds trust, and technology enhances rather than compromises security. By championing reliability and independence in digital identity verification, we lay the foundation for a resilient, inclusive, and trustworthy financial ecosystem.

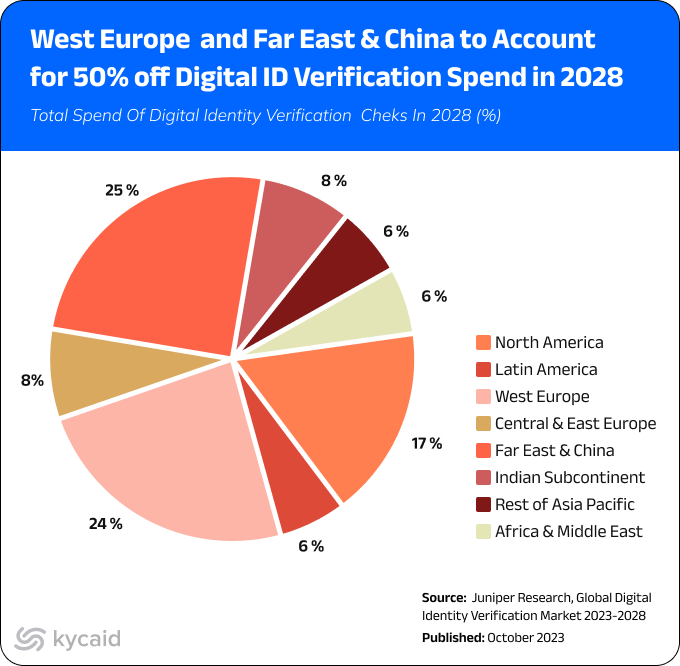

According to Juniper Research, the number of digital identity verification checks is projected to surpass 70 billion in 2024, marking a 16% increase from the previous year's 61 billion. This upward trend is expected to continue through 2028.

In 2024, the digital identity landscape is poised for transformative changes driven by several key trends. According to industry reports, the adoption of digital IDs is projected to grow by over 50%, from 4.2 billion users in 2022 to 6.5 billion by 2026, indicating a significant shift towards widespread integration of digital identity solutions. Advancements in AI and biometrics, including facial and iris recognition, are expected to enhance identification methods, albeit amidst concerns about AI misuse. Identity fraud prevention will remain a top priority, with increased adoption of multi-factor authentication and adaptive security measures to protect personal data. Financial institutions are set to embrace AI-powered KYC technologies to bolster security and improve customer experience. Additionally, preparations against quantum computing threats and initiatives like the EU Digital Identity aim to foster cross-border interoperability, shaping a dynamic future for digital identity marked by innovation and responsible development practices.

The landscape of digital identification is rapidly evolving, driven by advancements in technology and a growing need for secure, efficient, and user-friendly identity solutions. The future of digital ID promises to revolutionize how we interact with various services, from banking and healthcare to travel and online shopping. As we move towards this future, it is clear that identity verification solutions play a pivotal role in shaping it. These solutions ensure that digital identities are authenticated accurately and securely, thereby fostering trust and protecting against fraud. By leveraging cutting-edge technologies such as biometrics, AI, and blockchain, identity verification systems are set to become even more robust, reliable, and integral to our digital lives. In this transformative journey, embracing advanced identity verification solutions is not just an option but a necessity for a secure and seamless digital future.