Leading KYC & AML compliance solution

Digital Fraud Trends: An Overview

Discover the evolving landscape of digital fraud in today’s interconnected world. Our blog offers comprehensive insights into the latest trends, preventive strategies, and advanced solutions to fortify your business against cyber threats. Stay informed, stay secure.

Navigating the Future of KYC: What to Expect in 2023

As the world moves further into the digital age, the need to protect customer identity online is becoming increasingly important. Financial organizations, in particular, must be able to identify and verify customers for compliance with anti-money laundering and know-your-customer (KYC) regulations. With developments in digital identity, blockchain technology, and artificial

KYC & AML Compliance in the USA

Today it's already a common practice for financial systems to use tools for clients' verification to prevent fraud and fight money laundering. The conditions of the current state of the banking system involve the absence of operations anonymity, financial organizations fighting for transaction transparency, moreover, it'

5 Reasons Why Identity Verification Solutions Should Be a New Standard for Every Serious Business Venture

-------------------------------------------------------------------------------- Digitalization brings new challenges and risks to businesses and consumers. By making data more accessible than ever, cybercrimes such as data breaches, identity theft, and fraud are more rampant than ever. You need to invest in the right tools to protect your company and customers from potential threats and

Combating Fraud in The Field Of Finance

The problems of ensuring the economic security of any state are increasingly attracting the attention of the authorities, the public, and the scientific community. Economic security is a complex category reflecting all levels of public life. A high level of financial safety can be achieved only if effective methods of

An Insider’s Look at RegTech

-------------------------------------------------------------------------------- Many who are knowledgeable about Know-Your-Customer (KYC) and Anti-Money Laundering (AML) come from a financial institution background. They have a keen awareness of the challenges in maintaining high standards of compliance. These requirements apply not only to banks but also to companies and platforms that partner with credit unions

What do you need to know about sanctions and how to avoid risks

-------------------------------------------------------------------------------- The tense international situation provoked the introduction of new sanctions restrictions. A natural question that arises for every entrepreneur is how to find alternative solutions. How can they continue working given the current situation? To answer these questions, it will be necessary to consider several important innovations that will

Why is classic KYC not enough to meet all business needs?

Protecting the business from risks and rash steps is what the head of every large company thinks about. Cooperation with unproven brands or clients can not only ruin the reputation but also cause irreparable damage. That’s why many people use the KYC principle ("know your customer"), which

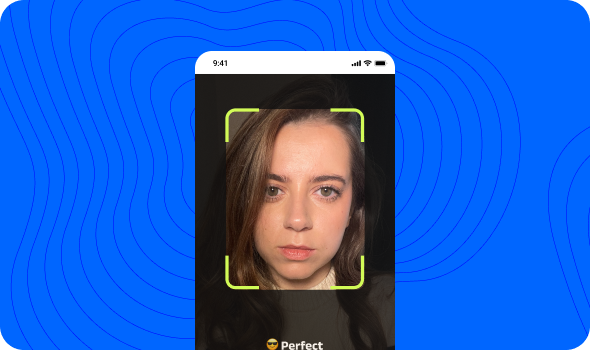

Identity proofing: what is it and what is it needed for?

-------------------------------------------------------------------------------- Security systems have become part of our daily life. To unlock our phone, we use face recognition, and to enter the banking application, we use a fingerprint. Hospitals, financial institutions, our phones – all of them use a recognition system to ensure that you are the owner of the data

Identity verification

Introduction for the newbies -------------------------------------------------------------------------------- What is identity verification? Identity verification is used in various fields, from banking institutions to hospitals. After passing the check, the person confirms that it is he who performs specific actions and this is not an attempt to cheat. This system is used by financial

KYC Pros and Cons

-------------------------------------------------------------------------------- Banks and cryptocurrency exchanges, the activities of which are based on financial transactions, resort to the “Know Your Customer” system. The KYC rules ensure verification of a person's identity for participation in illegal organizations, seized accounts, or possible sanctions. Before making your first transaction, you need to

How does knowing your customer process work?

-------------------------------------------------------------------------------- All financial companies use KYC as a set of requirements for identity verification. Thus, banks and crypto exchanges know who is registered on their platform and uses their services. Let's take a closer look at the verification process. While it differs from company to company, the purpose

Introduction to KYC

-------------------------------------------------------------------------------- What does KYC mean? KYC is an identity verification procedure used by all financial institutions from crypto exchanges to national banks. Know Your Customer identifies a person for security purposes and builds trust between customers and service. This system was created as a means to stop financial transactions for